All Credit Scores are Not the Same

Credit scores are one of those things that has consumers (and sometimes lenders) scratching their heads and saying “How did they come up with THAT credit score?”

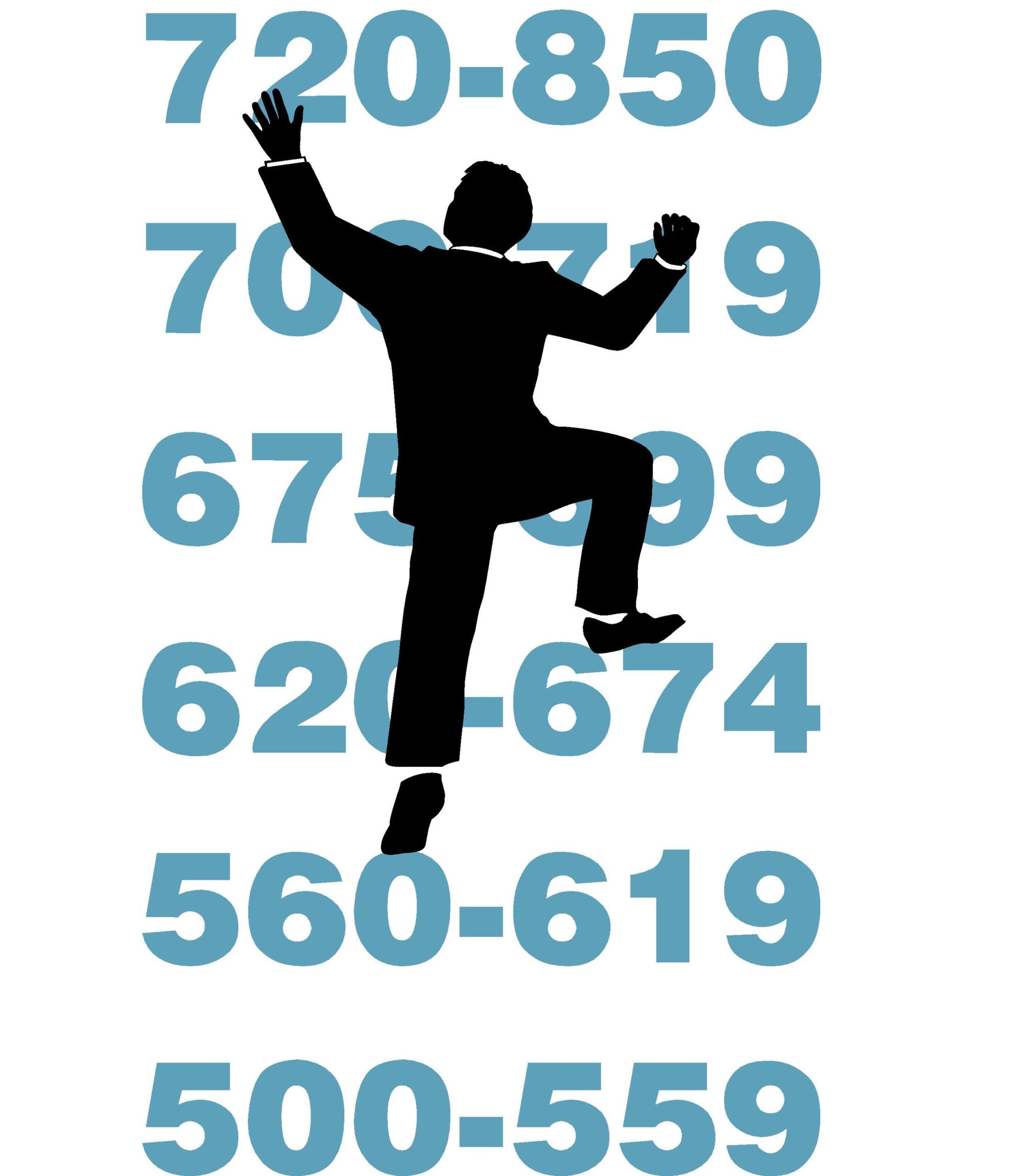

The one you hear about the most are FICO scores (acronym for the Fair Isaac Corporation, the creators of the FICO score). It’s the one that most mortgage lenders use as one of the benchmarks to see if you qualify for to refinance or purchase another home. Usually three scores are provided and the lender uses the middle score as the basis for granting (or denying) a loan.

However, not everyone uses FICO scores as a guide. Here are some other credit scoring models that are used:

Auto Loans

If you apply for an auto loan thru a dealer, they have developed their own credit scoring models which are completely different from those used by lenders.

Insurance Companies

Your insurance premium you pay for homeowners or car insurance also depends upon the credit score model that insurance companies use. Oh, and it will vary with different insurance companies.

Vantage Scores

If your occupation/employment requires you to be “licensed” (especially in the financial services industry) and one of the requirements to obtain (or maintain) your professional license, Vantage Scoring model software is used.

Free Credit Reports

According to law, you are entitled to one free credit report (per bureau) every year. While it won’t be exactly what lenders see when they order a credit report on your behalf, it will be “in the range” and is a good indicator of what to expect.

You are entitled to one free credit report—PER BUREAU. Go to AnnualCreditReport.com and you can request one credit report from EACH of the bureaus listed.

A word of caution! Be careful when signing up for offers to provide you with a FREE credit report. If you are asked to enter your credit card number, what you are really signing up for is a credit monitoring service—that may cost you over $300 per year.

Please contact us if you’d like us to review your credit report. We may be able to make suggestions on how to increase your credit score. Sometimes it just takes a little tweaking to increase it by 25 to 50 points.