Guide to Financing Your Home Renovations

You’ve made your house a home over the years. It holds lots of memories, and you wouldn’t dream of moving out. However, maybe your family has grown or they need more room to pursue the new hobbies and passions they discovered during the pandemic of 2020.

Doesn’t a larger kitchen sound appetizing? Or how about turning your basement into the rec room you’ve always wanted? Or maybe there are multiple smaller projects you’d like to tackle to give your home a fresh makeover and to meet your family’s changing needs.

Whatever home improvements you’re thinking about making, a Home Renovation Loan can be just the solution you need.

Remember, your home is an investment. When you make improvements like updating windows and doors, modernizing the bathrooms, or even building an addition, you’re also increasing the value of your home. In this article, we’ll talk more about the types of home renovation projects you should consider and the best ways of paying for them.

Advantages of Home Improvements Versus Buying a New Home

It’s common for homeowners to get bored with their living space. Repaint a few rooms, update the furniture, and that’s usually enough. Other people want big changes and consider purchasing a new home with all the niceties their current house doesn’t offer. But a home renovation might give you the best of both worlds.

The biggest advantage of tackling a home improvement project besides cost is you can update your space around your lifestyle and desires. Have a specific type of bathroom in mind? Want a comfortable rec room or man cave? For most families, it’s probably easier to renovate the space than packing up and moving somewhere else.

As mentioned earlier, you can increase the value of your home with the right type of home renovation projects.

Quick Tips for Getting Started with a Home Renovation Loan

- Know how much money you may need for your home renovation project

- Selecting the right contractor can help with tip #1 and keep everything on budget

- Narrow your loan options down to ones that match your project and finances

- Work with an experienced Great Midwest Bank loan officer to help you plan for a successful renovation

Choose Home Renovation Projects that Increase Your Home Value

Many homeowners will inevitably be faced with home improvement projects like painting, replacing a door or two, landscaping, etc. These maintenance projects will keep your home looking well cared for and inviting. Home renovation projects, on the other hand, deliver a new look and feel to your home. These are bigger, more complex projects that most homeowners trust to the pros and that means needing help paying for the renovations.

Let’s take a look at projects that’ll rejuvenate your home while adding value.

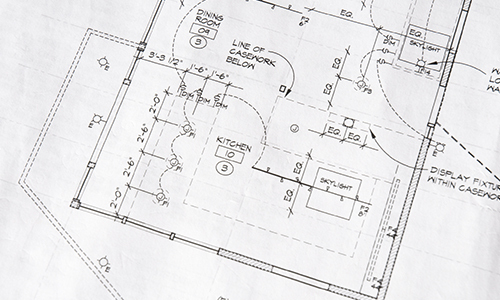

Remodeling Your Kitchen

The kitchen is the centerpiece of your home. It makes sense to update or upgrade your kitchen so it fits your lifestyle. But don’t go overboard. The kitchen shouldn’t be fancier than the rest of your house.

Bathroom Addition

Many of us are spending more time in our homes these days. Having an extra bathroom makes life so much easier with kids and when you’re entertaining house guests. Not every home has space or is equipped to add a bathroom. Start in the basement. It’s usually a great location for a modest bathroom, especially if you’re thinking about finishing your basement, too.

Adding Energy-Efficient Windows

Energy efficiency is on every homeowner’s mind these days. Drafty old windows are a big culprit of energy loss. So, while adding new energy-efficient windows isn’t the most exciting home renovation project, it is going to save you lots of money. Plus, they’ll increase your home’s curb appeal.

Backyard Deck Addition

Creating an outdoor living space has become very popular and for good reason. Adding a deck gives you plenty of room for entertaining or simply enjoying time outside. Go one step further and splurge on a stone fire pit or outdoor kitchen setup. Remember, it’s an investment, not just a luxury. 🙂

Home Renovation Projects to Avoid

While there are renovation projects that make good financial sense, other projects are worth avoiding. Especially if you’re thinking about moving in the next 2-4 years. The following renovations are satisfying but won’t increase the value of your home enough for you to make back what you would spend.

Swimming Pools

While the idea of a swimming pool while working from home seems wonderful and like a staycation, it actually makes your home harder to sell. Plus, there’s often an increase in energy usage, higher insurance, and it requires a lot of maintenance.

Gourmet Kitchens

When you customize your home too much, it turns buyers away. Having handmade tile backsplash and countertops plus commercial-grade appliances might be over the top. You should consider staying within what’s standard for the neighborhood or comparable homes.

Sunroom

A sunroom is the quintessential peaceful getaway for your morning coffee and reading the paper or a good book. However, not everyone is looking to have an extra room attached to their home that may go unused, especially if the climate is a factor. They may be other options you can consider.

What type of home loan financing is best for home renovations?

Ok, you’ve decided on updating, upgrading, and making big changes to your home. Exciting! The next thing to consider is your options for financing your home renovations.

At Great Midwest Bank, our experienced loan officers are happy to help you find the best fit for your renovation needs.

Home Equity Loan

When it comes to a minor remodel with limited home improvements, a Home Equity Loan is a simple and less costly option. Rather than basing the loan amount on the value of the home after the remodeling project has been completed, our local loan officers will either use a new appraisal value or a tax bill to determine the current fair market value of your home.

Major Renovation Loan

With local loan servicing and flexible underwriting using our own funds, Great Midwest Bank options can be a better financing option for larger renovation projects. Our loan officers and appraisers take into consideration the value of your home after the major remodel is complete. For certain borrowers, a Home Renovation Loan from Great Midwest Bank may offer a minimal down payment requirement and a “one-time close” feature with permanent financing included. It also offers interest-only payments during construction followed by normal monthly payments upon completion of the project.

Refinance Your Current Home Mortgage

Depending on your specific project, the refinancing of your current mortgage frees up the existing equity in your home. In many cases, there’s more than enough equity available to fund your home renovations. Plus, it may even lower your monthly mortgage payments.

When it comes to home renovations, we know there is a lot to consider. Whether you’re excited about upgrading your kitchen or really want a comfy basement for movie nights, talk with Great Midwest Bank. Our experienced team of loan officers are ready to help. Plus, they’re knowledgeable of local contractors who might be perfect for completing your home renovation.

Learn more about home renovation loans by visiting Great Midwest Bank or stop by one of the convenient locations.