Seven Credit Report Myths

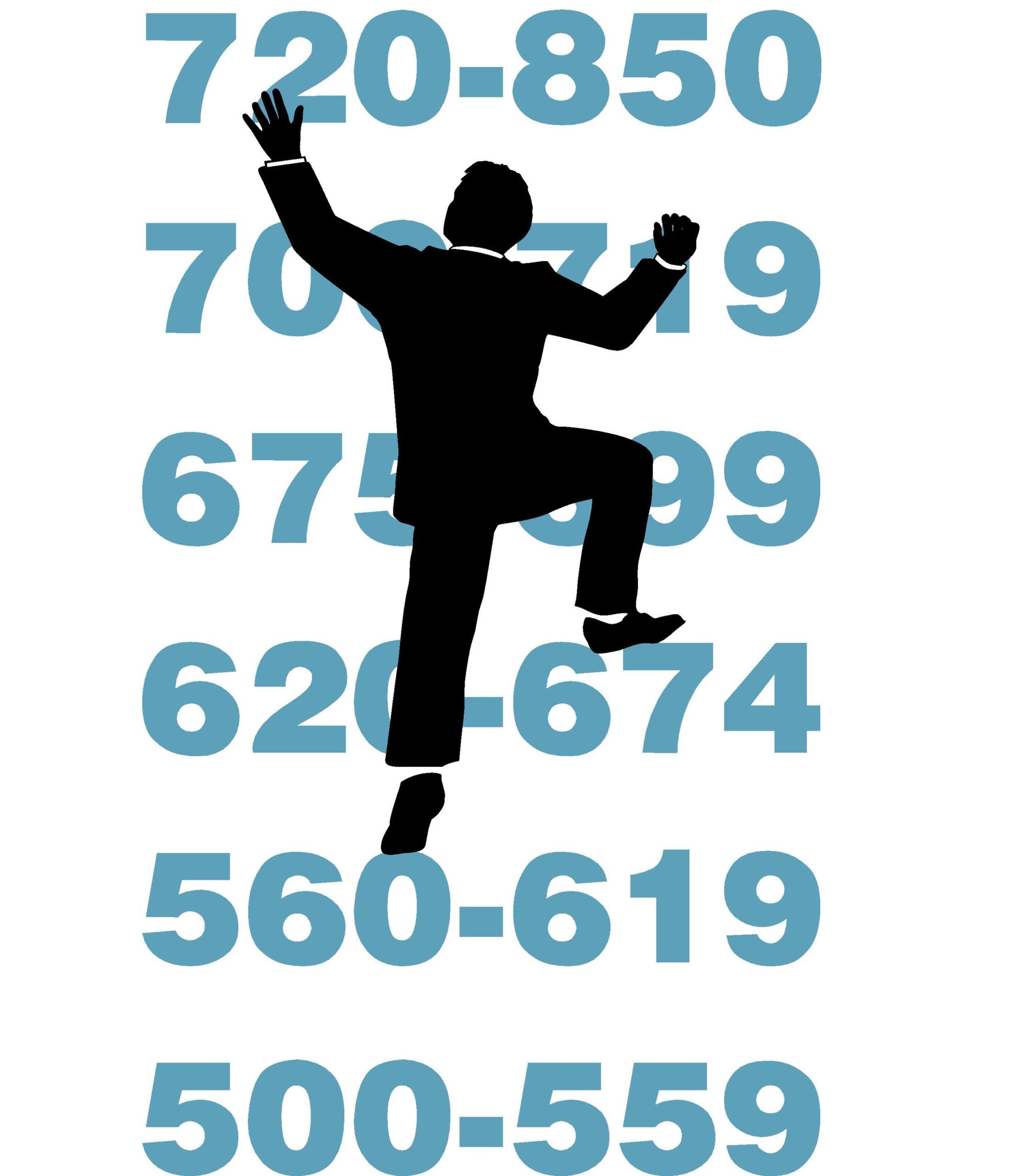

It’s that time of year when many of us start our financial planning for 2016. For some of you, that might include a home purchase or refinancing. The rates and fees you pay for these often depend on your credit score, which can be a source of anxiety.

It’s that time of year when many of us start our financial planning for 2016. For some of you, that might include a home purchase or refinancing. The rates and fees you pay for these often depend on your credit score, which can be a source of anxiety.

When it comes to your scores, there are a few Urban Legends:

MYTH – Your annual “free credit report” includes your credit score.

REALITY – At annualcreditreport.com you will find some valuable account-by-account information, but it does not provide a free score. But options exist. You can pay for your score. But even if you pay, it may not be the type of score that mortgage lenders use. Today, Credit Karma is a great option to consider if you want to monitor your scores from time to time. The service offers a convenient app for your smartphone as well.

MYTH – Your income or medical history appears on a credit report.

REALITY – Your credit report includes information that is debt related. It also includes your social security number, birth date, and address. We often see names of employers and prior addresses. In addition, as a mortgage lender, we have access to recent credit inquiries to determine if any new debt exists outside of the scope of the information provided. Most account information on a credit report is a month old.

MYTH – Checking your own credit score will cause it to drop.

REALITY – You could check your own credit score every day—and it will have no impact. On the other hand, if you authorize a potential creditor to “pull” a credit report on your behalf, it may decrease your credit score by a few points. However, the bureaus suggest that you get a break if you are “shopping” around for a car loan or a mortgage. Theoretically, the credit bureau views multiple inquiries by different creditors within a 30-day time period as one inquiry. If you decide to shop for a mortgage, we recommend applying formally with one company and asking for a copy of your report, or scores. Armed with that information, you should be able to get an accurate quote from other potential creditors instead of formally applying at each one.

MYTH – If you pay off a past-due account, it will be removed from your credit report.

REALITY – Time is the only thing that will clear up a negative account, judgment or collection from your credit report. It can take up to seven years for it to completely disappear. However, as time goes on, assuming you pay your bills on time, your credit score increases.

MYTH – The credit report will merge when you are married or split if you are divorced.

REALITY – Everyone has their own credit report. The act of getting married does not cause the information on the credit report to be combined, only joint credit. So, if your spouse has problems on individual credit accounts, it won’t show up on yours. However, if you and your spouse divorce and you have joint accounts—where both of you have signed to be responsible for the loan — it will appear on both of the reports. Just because you split up and the judge says that one (or the other) person is “responsible” for paying the debt, both of you are still obligated to pay the debt and the report will be reflected as such.

MYTH – If you pay your bills on time, you don’t need to check your credit report regularly.

REALITY – Your credit report is changing all the time. A creditor may make a mistake and report that you missed a payment. And fraudulent account openings are common in today’s world.

MYTH – The credit bureau is the one who approves or denies your loan.

REALITY – They are merely a reporting agency—gathering information from your creditors. The lender is the one who makes the ultimate decision based on what’s in the report.

Interested in learning more about your credit history or ready to start the mortgage loan process? Schedule an appointment to meet with one of our friendly, experienced loan officers today by visiting our new and improved website, greatmidwestbank.com.

(Photo source: http://www.minteerteam.com/)